A Complete Guide On Avoiding Hedge Funds

A hedge fund is a funded pool and private investment association that uses different and complex established ways and trades or invests in complex goods, like unlisted derivatives and listed derivatives.

It's an alternative investment that offers recognition as investors in the exclusive market. These funds can stay away from taxes by sharing profits to ensure seaward to Bermuda, which they develop free of taxes and then reinvest back into the fund.

There are so many ways hedge funds avoid paying taxes. In this article, you will learn how hedge funds avoid paying taxes.

Hedge Fund Overview

Before going to the tax stuff, let's understand what a hedge fund actually is. It is like a team led by the fund manager, who works like a ship's captain. The team includes experts who use some logical and fancy tax avoidance strategies to make money for the fund.

These funds are generally maintained as partnerships with one main partner and a team partner. Everyone on the team has a different role to play in making the fund successful.

Ways of Hedge Fund 2% Management &'' 20% Performance Fee

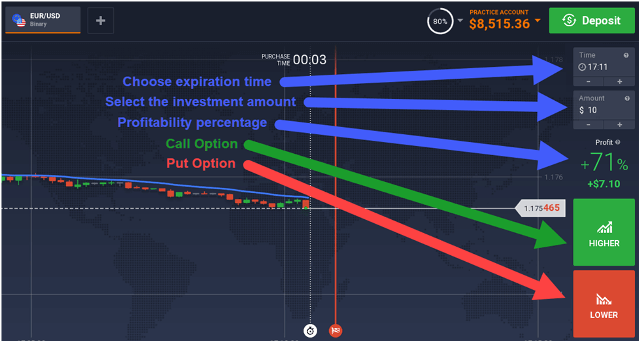

Sophisticated tax planning is very important. In general terms, there is an assertive wage structure that hedge funds may use, and it is committed to 2 &'' 20. 2% is for management fees, and 20% is for performance fees with some great ideas with the fee structure; moreover, try to get away from income tax by depending on the production and blend of income through calculating value to consequence in capital increase and not ordinary income.

2% Management Fee

It does not depend on the performance of the fund, but it depends on the overall performance. It is more about how much you have to invest in the fund. Therefore, the more you invest, the more you pay in fees.

For example, if anybody puts $10 million into the fund, they would owe a $200,000 management fee. Generally, this fee is taxed as normal income for a hedge fund. It is like regular billing, which they have to pay.

20% Performance Fee

The performance fee depends on how well the fund does. Suppose the fund increases by 5%, which makes it worth $10,500,000. So, the fund would charge 20% of that increase, which comes to $100,000. This is how funds aim to avoid normal income. Thus, rather than being taxed like regular income, this fee is treated uniquely.

Tax Method Wrap Economic Motive

There are two main things that are wrong economically with the specific tax provisions in hedge fund managers. One is the impact on economic efficiency. This build is incompatible with economic incentives such as distortions; labor income is treated as a sum of income.

On the other hand, some income from labor is treated as an amount of gain, and all work completed by investment counselors is undeniably an expert laboring activity. When you work as a manager, things are like endowments or pension funds.

Usually, you get paid a salary and a bonus. This money is like regular income, though if you are a manager at a hedge fund or a private equity company, you might be managed using a tax minimization method that lets you pay less tax on your earnings. This type of treatment means that extra-rich fund managers finish with this method with more money after taxes than regular people who work hard for their paychecks.

These managers do not need or deserve these tax breaks. In a 2006 survey, some hedge fund managers made frantic money, such as billions of dollars! That is more than others can't even imagine, and this type of thing happens almost yearly. It's completely unfair when you think about your hard work and who struggles to make ends meet.

Tax Information for Hedge Funds &'' Private Equity Tax

whereas the word hedge fund has become one of the many financial sector phrases that scares consumers, it is typically not as horrible as it looks. Generally, a hedge fund functions similarly to an LLC or LLP, with a few additional challenges.

Complexing the problem of hedge funds is generally the problem that involves international taxation and normal taxation of determined income-absorbing hedge funds. Hedge funds make some money. Now, the question is, do they have to pay high taxes on that money, like on regular income? Or do they get a break and pay less tax because it is treated more like investment income?

These are important things because investment income usually comes from lower tax rates. Therefore, it is like determining whether you are paying the full cost or getting a discount on your tax rates.

Furthermore, throwing worldwide personal equity funds into the combination of things gets even more difficult. You are talking about the latest versions of complexity with terms including GILTI popping up, PFIC, and Subpart F. It is like entering a new level where every turn leads to more confusion.

So, just break it down to how hedge funds and private equity get taxed and reported.

Way To Avoid Hedge Fund Paying Taxed

To know how hedge funds are taxed, you can learn through the basics. Many hedge funds are maintained by the partnership or with some limited liable firms. These are called "flow-through entities". It means that there is only one level of tax that flows through to the different investors rather than two separate taxes for the entity and the partners or stakeholders.

You can think of a straight line from funding to investors. If you invest in a hedge fund, you will get a form known as K-1, which breaks down how much money you made and the expenses you might have. You can say that it is like a road map for taxes.

Conclusion

Hedge funds have different fee structures like 2 &'' 20, where 2% is for management and 20% is for performance. While management fees are taxed as regular pay, performance fees aim to avoid common taxation.

Understanding these fee structures is a basic way of navigating the tax suggestion of hedge fund investments. You can grab more information about ways hedge funds avoid paying taxes.