Comprehensive Guide On Calculating PV Bond with Excel

Microsoft Excel is a perfect way to calculate the latest value of a bond. Generally, Microsoft Excel allows many methods to add the latest value of a bond, such as a conventional formula, PV function, or PRICE function. The latest value may be referred to as the previous value, which includes different kinds of interest. The word "bond" refers to a kind of debt instrument that pays regular interest in coupon form, and these bands are called coupon bonds. You can also find such bonds that are unpaid coupons, though there are some problems at a lower cost rather than redeemable value; this kind of bond is called deep discount bonds or zero-coupon. Here is guidance on how to calculate the PV of different bond types with Excel.

What Is Bond?

A bond is similar to an IOU (I Owe You). An organization or government that issues the bonds owes money to the people who hold them. People promise to pay back the cost they borrowed, with interest, on an assertive date. It is kind of like getting a loan; instead of going to the bank, they borrow from people who purchase their bonds. This helps the government and businesses get money when they actually need it.

3 Ways To Calculate PV of a Bond in Excel

Applying Conventional Formula

In the first step, you can use a conventional formula for calculation. The latest value may be done for zero-coupon or coupon bond. The conventional formula is used to calculate the PV of bond formula. Price = ( Coupon 1 ( 1 + r ) n r ) + Par Value ( 1 + r ) n The standard formula for calculating the PV of a zero-coupon bond is listed below: F= Face Value C Annual Coupon Rate r = Yield to Maturity n = Number of Compounding Per Year t = Number of Years Until Maturity

Using PV Function

The most effective way to find out how much a bond is worth presently is by using the PV function formula in MS Excel.

This function helps us find out the PV of our investment. The PV function is used for three different scenarios during the calculations of bond value. One is for zero-coupon bonds, which do not pay interest. The other one is for bonds that pay interest semi-annually.

The most effective way to find out how much a bond is worth presently is by using the PV function formula in MS Excel.

This function helps us find out the PV of our investment. The PV function is used for three different scenarios during the calculations of bond value. One is for zero-coupon bonds, which do not pay interest. The other one is for bonds that pay interest semi-annually.

Using PRICE Function

Another method to find out the value of a bond is using the PRICE function in MS Excel. This function supports us in calculating how much a bond is worth; use this function with a dataset that includes some key guides: when the bond begins, when it finis, how much interest it pays, what rate it is earning, how much you will get back when it matures, and how often the interest is paid annually. This helps to check out the bond's current value.

PV Annuity

When you put a deposit into your savings account, you must pay the home mortgage, and usually, you make similar payments in daily intervals, including quarterly, yearly, weekly, or monthly. These types of series payments(such payments can include outflow or inflow) are created at equal levels of intervals, which are known as annuities. The PV of an annuity may be described as the latest value of a series of upcoming days' amount flows by giving a limited discount rate and return rate. In this way, PV is usually known as the latest discounted value. The higher the discount amount, the lower the present price. The idea behind the PV comes from understanding the value of money over time. Generally, having an amount now is better than having a similar amount later because you may use it to make money. Sooner you get the actual amount of money, the more valuable it is. In simple words, it is like to say that having a dollar now is better than having a dollar tomorrow. In the aspect of financial analysis, current value is very necessary. It lets you clearly know how much amount you require to invest now to reach the desired amount in the upcoming days. Knowing present value can also be convenient in daily situations. For example, it may help you decide whether to take a cash refund, evaluate a project for your business, and many more. In daily life, current value supports you in checking out what is more beneficial to you, such as getting a big sum of money upfront or receiving smaller payments over time.

How To Calculate Present Value In MS Excel - Example

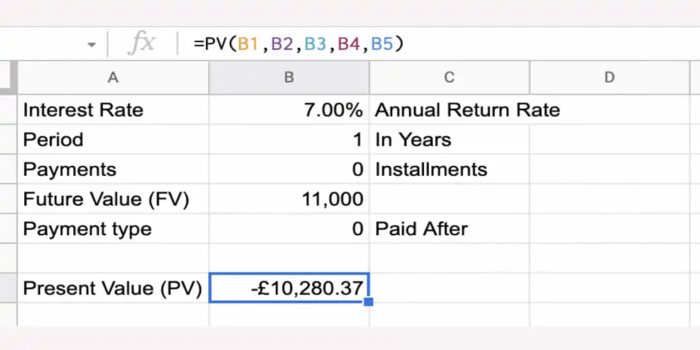

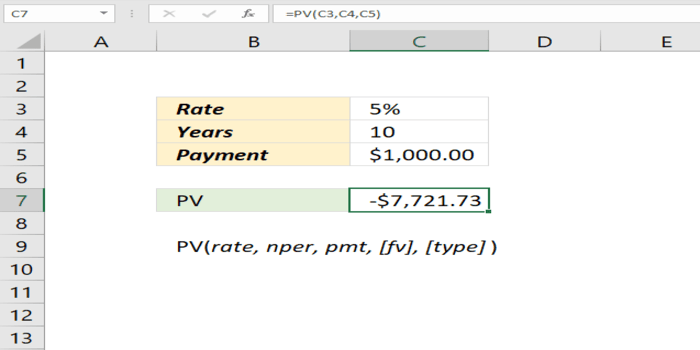

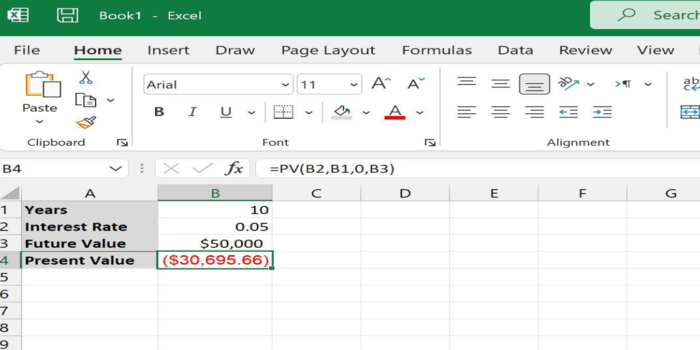

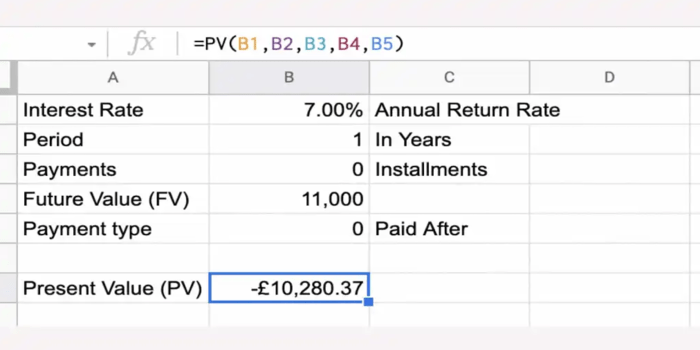

Here is an example of how to calculate the PV of a different bond type with Excel. In the previous content, you can see the PV of annuity, and the best part is that MS Excel has a particular PV function that calculates the behind output of the final conclusion in a cell. If you do not know the function, then it is an excellent idea to start with some tutorials that describe syntax efficiently.

Here is an example of how to calculate the PV of a different bond type with Excel. In the previous content, you can see the PV of annuity, and the best part is that MS Excel has a particular PV function that calculates the behind output of the final conclusion in a cell. If you do not know the function, then it is an excellent idea to start with some tutorials that describe syntax efficiently.

PV Analysis

PV analysis supports finding out the value of different things, such as real estate, annuities, stocks, and bonds. In MS Excel, you can calculate NPV by using the formula of PV =(rate, nper, pmt, [fv], [type]). If you leave out either FV or PMT, then you need to include the other one. But you can include both if you want.

Conclusion

if you want to know more about how to calculate the PV of different bond types with Excel, this article will definitely help you out. MS Excel is a good source to find out the PV of different bond types. In the above article, you can get information about the three methods to find the PV value effectively. You can also use present value calculator excel template.