Difficulties of Earning the First $1 Million

The idea of earning the first $1 million is possibly the most difficult challenge on the long road to financial success that exists in the fascinating space between a reoccurring motif and viral cultural phenomena. Yet it's true for profound and intriguing reasons.

In addition, exploring the nuances of the difficulties linked with achieving that crucial first million can provide you with the information and tactics required to get beyond these barriers and achieve this remarkable financial goal. Undoubtedly, becoming a millionaire is no joke.

But why the first $1 million is the hardest? Let's get into it to find out.

Seven Basic Things You Need To Know About Earning the First $1 Million

First, let's start with how becoming a millionaire is similar to acquiring a mountain. Starting from the bottom, you look up at the top and reflect on yourself, and then we will find why the first million is the hardest book.

11 Million Millionaires

We all know that those who have earned more than a single million in net worth are known as millionaires, but do you know that there are currently over 11 million of them?

The Strange Nature of Wealth

Who said the first million is the hardest?

Rich people often joke that getting their first million dollars was the hardest thing they've ever had to accomplish.

Wealth vs. Income

At some point in life, you must have wondered what the difference is between having a million dollars in net wealth and making a million dollars in a single year. Even though most people hope to get a net worth of more than a million, in reality, only some actually make this happen in a single year.

It's important to remember that extravagant gains are not always a sign of riches, as history is full of instances of celebrities, business owners, athletes, and lottery winners squandering enormous sums of money on fripperies.

Furthermore, some people who are referred to as million-dollar earners actually do not make that much money. Even when a business brings in a million dollars a year,

its owner still has to spend the majority of it on overhead. In the same way, one is not automatically a billionaire if one buys a million-dollar home that is burdened with a $3 million debt.

The Strong Force of Addition

There is no doubt that the first million dollars seem so far away because, in comparison to most people's starting point, it's a substantial amount of money. A 100% return is required to increase assets from $400,000 to $1 million, an achievement that usually takes longer than five years.

Comparably, rising from a million to several million necessitates another 100% expansion, but increasing million-dollar increments after that call for gradually fewer percentages 50%, 35%, and so on.

Many rich people put a portion of their wealth in a safe portfolio of income-producing assets, allowing them to live free from interest. Thanks to this strategy, they have the freedom to investigate other profitable investment options.

Starting Challenges

The modest rate at which people save throughout their early years is one of the main obstacles to saving a million dollars. Although some professions start at more than $50,000,

These are the exception rather than the rule. Student loan repayments, rent, and the difficulty of scraping together enough money for a modest lifestyle are common issues faced by recent graduates.

Even for the few disciplined individuals who are able to set aside $11,000 or $16,000 a year

without taking interest or compound growth into account, it would take them forever to collect a million. However, as people get older and get more experience, their image changes.

Pay increases are common, and many people discover that they are no longer responsible for hefty upfront costs like college loans. They buy everything they need to live a peaceful life.

The Advantage of Extra Wealth

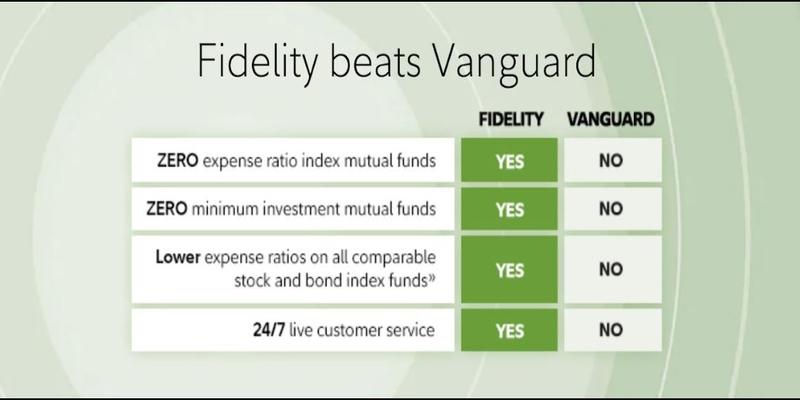

Rich people have access to investment opportunities that are out of reach for other people. For example, most people still cannot access hedge funds because of regulatory income and wealth restrictions.

Similar to this, investing in "ground floor" opportunities or asset types like timberland or farms frequently necessitates a sizeable down payment.

Handling Risk Aversion

Fear of risk is another often overlooked barrier to wealth building. Many people carefully manage their meager savings because they worry that they might lose everything. This makes sense, but it's crucial to recognize that risk and reward have always been related.

The path to the first million may be prolonged by playing it excessively safe, which can result in bad returns. On the other hand, those who are wealthy enough to endure market downturns or economic downturns frequently take greater chances in an effort to increase their profits.

Optimize the Way Your Money Works for You

Enhanced passive profits and Cash Flow

The potential for passive income from interest, dividends, and rental income increases as your wealth does. Reinvesting passive income allows you to take advantage of compound growth even more. In the end, you can use it to fund new projects or investments.

Increasing Diversity Gets Easier

Diversification might be difficult when you have little money. You can diversify your investments over a wider range of assets if you have a million dollars or more, though.

Exposing you to several growth opportunities and lowering risk helps prevent your entire portfolio from being destroyed by a downturn in one area.

Change in Psychology

Reaching your first million is an important psychological as well as financial milestone. It instills self-assurance and the conviction that you are capable of much more.

This change in perspective may serve as the impetus for taking bigger risks and going after more lucrative opportunities, as long as they are reasonable.

Conclusion

Now you know why the first $1 million is the hardest. So don't worry if you're feeling discouraged because you haven't reached that first million yet. You're not by yourself. Just keep in mind that there is no average age to make first million;

Everyone who has achieved success begins at nothing at some point. It all comes down to working hard, picking up from your mistakes, and never giving up. Who knows, maybe after a few years, you'll be joking about how difficult it was to reach that first million.

Just think that earning your first million dollars is similar to embarking on a new adventure. It's frightening, thrilling, and full of ups and downs. But you will eventually arrive at your target if you remain dedicated and keep moving forward.