Dow Jones Industrial Average vs. S&P 500: What to Prefer As Per Your Requirement

Are you trying to examine the difference between the Dow Jones Industrial Average and the S&''P 500? If yes, then you are in the right spot. This article will help you better understand the Dow Jones Industrial Average vs. S&''P 500.

DJIA (Dow Jones Industrial Average) and Standard and Poor 500 indexes are the most famous stock market indices of America. Although they are both used for the same motive, some businessmen prefer one for certain reasons.

These indexes indicate whether the market value or stock price is moving down, up, or crabwise. Also, check to what extent the stock price is moving. Both indexes use different methodologies to investigate the current market value.

Want to know more about the Dow Jones Industrial Average vs. S&''P 500? Keep reading!

DJIA (Dow Jones Industrial Average)

The Dow Jones Industrial Average is the American-based original market index. It was established in the year 1896 to trace the 12 largest corporate names in the nation. At present, this index comprises thirty blue-chip companies. Some more features of this index are discussed below.

The term industrial is actually a historical artefact in its denomination, as the majority of the stock index does not belong to the manufacturing industries these days. In fact, they are pinched from the prime sectors, excluding transportation and utilities, as they own their indexes.

This stock index is widely used in America. All the names of modules of the Dow Jones Industrial Average are identical to brood names like(KO) Coca-Cola, (MSFT) Microsoft, (DIS) Disney, and (JNJ) Johnson &'' Johnson.

How the Dow Is Weighted

This index is cost-weighted. Instead of applying simple arithmetic mean and then dividing the answer by the sum of stocks, the company uses Dow Divisor. This formula levels out the outcomes of commodities split and dividends.

Therefore, the Dow Jones Industrial Average is only affected by the alternations in the market values. This means that the companies with elevated share costs or utmost price movement are highly affected by the Dow.

S&''P 500

The Standard and Poor 500 index was established in 1957, and it traces 500 substantial openly traded stocks. This is also an American-based authentic index market that is working on a wide level. This market includes stocks from all quarters of the economy.

The S&''P 500 committee then selects the stocks that qualify as per the selected criteria. This index market has been overtaken by the financials at 12.4%, information technology at 28.3% extent, and healthcare at 13.4% extent.

The ten head components, according to the index weight of 30th June 2023, include Amazon (AMZN), UnitedHealth Group (UNH), Berkshire Hathaway Class B (BRK.B), Alphabet Class C (GOOG), Alphabet A Class (GOOGL), Microsoft (MSFT), Tesla (TSLA), Apple (AAPL), NVIDIA (NVDA), and Meta A Class (META).

How the S&''P Is Weighted

The S&''P 500 index stocks are weighted on the basis of current market value instead of their current stock prices. This unique method of the S&''P 500 index verifies that the effect of every 10% swap in a $20 commodity will be the same as the 10% swap in a $50 stock.

Selection Criteria: Dow Jones vs S&''P 500

The selection criteria of the DJIA company are indefinite. The companies applying for the Dow Index are all movers and shakers. The elements included in the DJIA only swap sometimes. Companies cannot be added to or eliminated from it within a certain time. At the time of review, only one company may get replaced by the committee members.

The selection criteria of the S &'' P 500 index are quite fixed and clear as compared to the DJIA. The companies must comprise a stock market cap of at least $12.7 billion, a minimum 10% public float, and an effective earning for the current four quarters. In addition to that, the company must have appropriate liquidity based on volume and price.

Which Is Better: the Dow Jones or the S&''P 500?

You can rank the two index markets according to your needs and observations. There is no certain answer to this question as both are the front runners of the United States economy. Both of them are also among the largest companies in the world.

One major difference that holds the attention of business people is that the S&''P 500 index consists of the largest 500 companies while the Dow Jones has only thirty blue chip firms. Due to this reason, some investors consider the S&''P 500 more reliable and accurate.

How To Invest: Dow Jones Industrial Average vs S&''P 500?

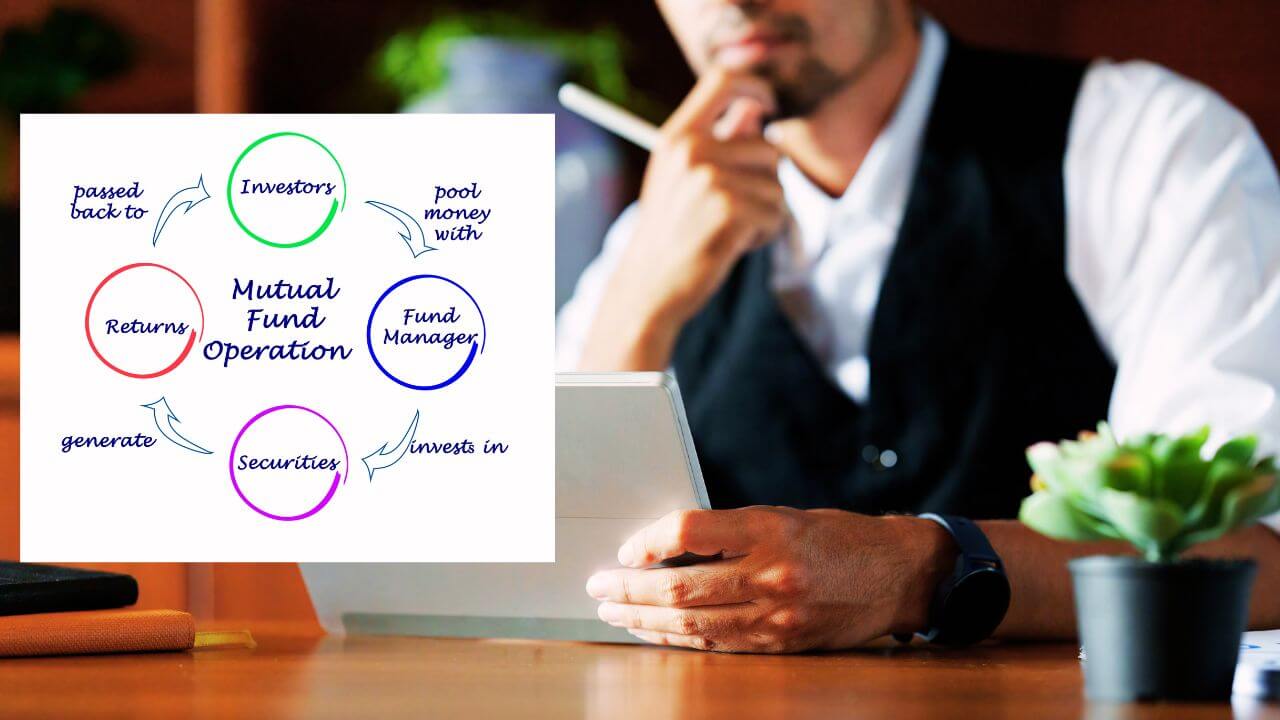

The investors cannot directly invest in any of these market indexes as they are not the investment platform. You can put money into the securities that keep tabs on their performance. The investors can benefit from the changing market values.

You can buy shares in assets like ETFs and mutual funds as they try to copy the performances of the Dow Jones Industrial Average and S&''P 500 index. There is no such market performance comparison as both are equally demanded and are leading powers of the United States.

How Are Stocks Added: Dow Jones vs the S&''P 500

The methodology applied for adding the stocks to Dow Jones and S&''P 500 are quite different from each other. The constituents for Dow Jones are added by the particular Dow committee formed for this purpose. It is a toll-weighted pointer consisting of 30 companies.

S &'' P 500 index is weighted on the basis of market capitalization. Constituents of this market index are affixed by using a specific formula instead of applying a simple arithmetic mean. This difference in adding the stocks lets the investors decide what to choose that will benefit them.

Conclusion

Dow Jones Industrial Average vs. S&''P 500 is a noteworthy debate for investors. Both of them are the front runners of the American economy. However, investors prefer the S&''P 500 index because it has more companies than the Dow Jones. The general purpose of the two are quite similar.