Enhance Your Disposable Income Now To Make Your Future Financially Secure

These days, everyone wants to enhance their discretionary income, but they don't know how. Well, it is all about making some significant changes in your budget that will help you save more money.

The amount that remains after deducting taxes from your gross income is your disposable income. It is an essential sign of your financial well-being.

It usually starts with total earnings and deducts all obligatory taxes, such as income tax, Social Security, and Medicare contributions, to arrive at disposable income.

The amount that is left over is what can be spent, saved, or invested. However, multiple variables can affect your disposable income, such as tax band, cost of living, and income level.

If you want to learn how to increase your disposable income, keep scrolling.

How To Boost Your Disposable Income Through Budgeting

Check And Control Expenditures

To start any budgeting process, you must understand where your money is going. First, you need to get your hands on bank statements, credit card bills, and receipts. Your expenses can be divided into fixed and variable categories.

But is the process complicated? Here is the best part: there are multiple software and digital solutions available that can make this process easier for you.

Not only this, but you can also seek financial experts for any other help. You can spot trends and areas where you can save money by putting your spending habits on paper.

Automate Bill Payments And Savings

Automation has the potential to revolutionize financial management in the era of digital banking. As soon as you get paid, set up internet transfers from your checking account to a savings account. Just keep in mind that you need to pay yourself first.

By following this strategy, you may make sure that some of your income is allocated directly to savings. Likewise, automated bill payments guarantee that you always pay attention to a deadline, saving you money in late fees and penalties.

This money management is much easier, as it will help you lessen the desire to spend money on things that aren't necessary and encourage budgetary restraint.

Set Essential Expenses First

While taking all these steps, you need to put your essential expenses first, such as rent or a mortgage, utilities, groceries, and health insurance, because these things are not negotiable.

Make sure your budget prioritizes covering these expenses. This personal income formula will surely be helpful.

Cut Down on Optional Expenses

After you've taken care of the necessities, you can rest assured and focus on discretionary spending. Items like entertainment, eating out, and shopping sprees, even if these costs improve your quality of life, you can still reduce them without significantly lowering them.

For example, instead of making frequent excursions to the movies, think about streaming movies at home. Review these costs on a regular basis to see if any adjustments can save money, such as renegotiating contracts or changing suppliers.

No doubt, these disposable income examples will help you understand it clearly.

Set Careful Savings Plans

We all know that it is a wise choice to save money for a rainy day check. Setting and sticking to specific, attainable savings goals will help you save for a dream vacation or a down payment on a property.

You can divide up significant objectives into smaller, more manageable ones that can be reached right now. These objectives serve as inspiration, which makes it simpler to put off short-term pleasure in favor of long-term financial rewards.

Use A Cash-Only Approach To Spending

You must want to spend less on your expenses, but the problem is, how? Paying using cash provides a psychological benefit over using a credit or debit card since it feels more substantial and causes you to pause before making a purchase.

Try to set aside a certain amount of money each week for unnecessary expenses, and after it's gone, fight the need to take out more. This disposable income formula proves very helpful in decreasing impulsive purchases by promoting deliberate shopping.

Other Ways To Increase Your Disposable Income

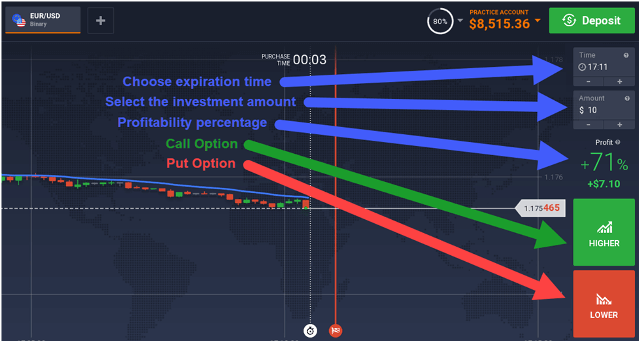

Boost Your Income with Freelancing Or Side Jobs

You can boost your extra revenue streams from side projects or freelancing work, which can enhance discretionary income and act as a financial cushion.

These activities can also help you with networking and skill development. Sounds impressive, right? Moreover, your interests and talents can frequently be rewarding endeavors.

Discuss Pay Increases Or Bonuses

Seeking more compensation proactively boosts profits. Assess your contribution to the organization first. When you speak with superiors, quantify your accomplishments, make sure they match the company's goals and communicate them clearly.

It is helpful to learn about and comprehend the going rates for your position, level of experience, and area. Make use of this information to support your plan so that it is based on actual market trends.

Remember that timing is everything. Approach these discussions when a project is completed or during performance assessments.

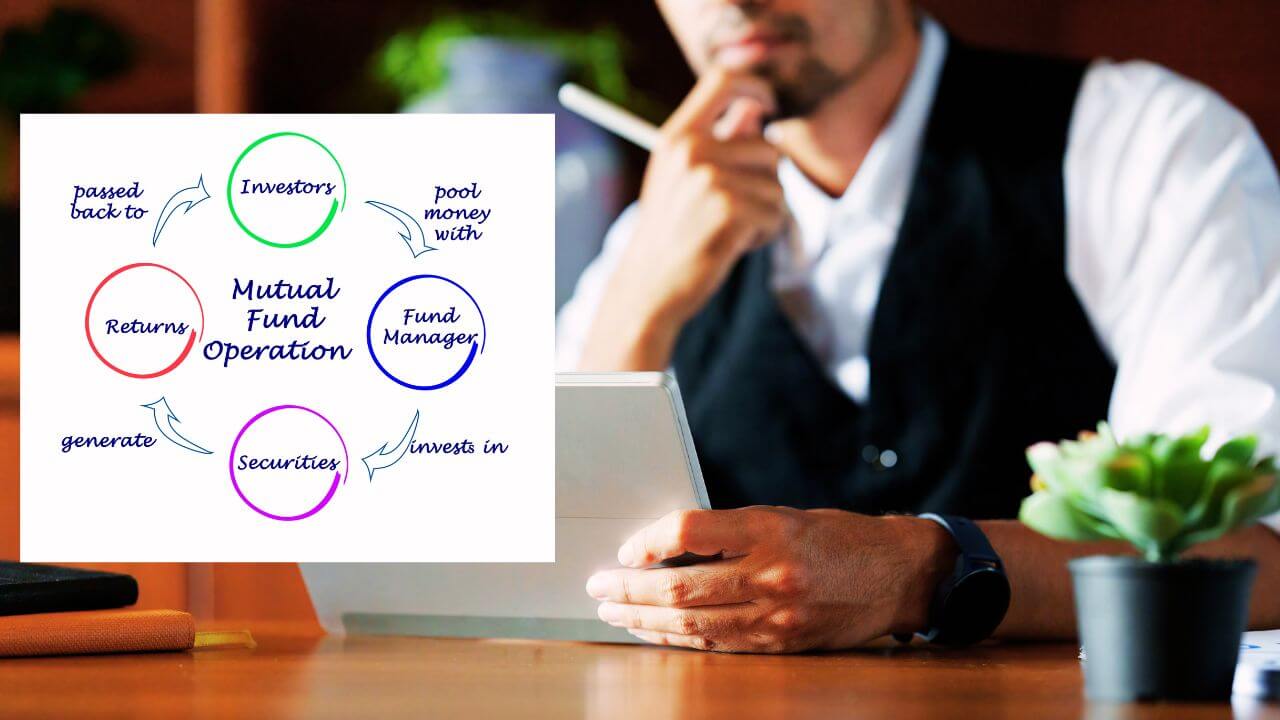

Optimize Tax Credits And Deductions

We all know that taxes are essential, but do you know that they also present opportunities to save money with credits and deductions? Your disposable income increases directly with each dollar you save in this area.

Try to learn about the different types of deductions that are available, ranging from property ownership and charity contributions to health and education costs. Think about using a tax professional's services. Their knowledge can help you find ways to reduce your tax burden and keep more of your hard-earned money.

Consult a Professional

Undoubtedly, personal finance can be complicated sometimes, even with a wealth of information at one's disposal. A financial planner or advisor can provide clarity and assist you in making difficult decisions.

They contribute knowledge and insight, which will help you create a financial plan that works for you. But remember that before using a financial advisor's services, it is imperative to verify their credentials and standing.

Conclusion

Disposable income is actually the money that is left after you pay your taxes. To make sure you have more of it, keep an eye on how much you spend, try to save money regularly, focus on what you really need, cut back on things you don't really need, and set up automatic payments for bills and savings.

But don't think that managing your money means you can't have any fun. It's all about finding a good balance between having fun now and saving for later. That way, you can enjoy yourself while also working towards your financial goals.

Hopefully, now you know how to increase your disposable income.