Fidelity vs. Vanguard: Comparing 401(k) Providers

Fidelity and Vanguard are both popular options in the field of brokerage accounts. However, as a beginner or newbie, it is nearly impossible to try both options, one followed by the other, and the inclination to choose the best remains intact. So, are both services the same? Or are there any features that grant one survive an edge over the other? Wondering the same question? The same is why we have formed this guide, which obtains a head-to-head battle between Fidelity vs. Vanguard to compare and contrast the services before concluding. So, without wasting even a single minute more, let's get learning.

An unbiased analysis of Fidelity vs. Vanguard: Comparing 401(k) Providers

We will discuss the aspects of both services to compare and find the more suitable option for a trader.

1: Stability status

Although Vanguard lets new consumers open an account online, there is a several-day delay before you can log in and invest in it. On the other hand, the process is more straightforward and quicker than Fidelity. It allows you to register and begin quickly. At the same time, Vanguard's official website has been recently updated, yet it needs an extensive range of tools offered at the Fidelity site. This is why Fidelity is a good option for all those who want to start trading and access valuable and advanced tools. Nonetheless, if you are an experienced trader, you can go with Vanguard due to its efficiency in long-term investment.

2: Trade experience

Vanguard's trade experience and desktop experience are more inclined towards the "Buy and hold approach,"which means the order entry process is clunky and intuitive. In addition, there is no facility for real-time data until the user opens the trade ticket. Remember that the service is intended for frequent traders or those who like to make short-term investors. Instead, it is meant to serve traders with long-term investment; Fidelity has a comparatively better trading experience even though they are seasoned, frequent, new, or expert traders. Hence, it does not matter if you want to be a short-term investor or jump into a long-term investment. Being a web-service platform, it can delay the quotes for 15 minutes unless you sign up for the real-time quotes. The recent dashboard system has robust enhancements with new thematic baskets, quick rebalancing features, and custom indexing. Thus, it established that it is a more reliable option for those seeking a better desktop experience than Vanguard.

3: Mobile experience

Vanguard aims to cater to those who are not frequent traders and use applications sparingly. The same is why the Vanguard mobile application is outdated and lacks an extensive range of features needed in today's trading environment. For instance, you won't find any charting feature. The quotes are also delayed until the se opens the order ticket. You can perform some basic actions such as checking the positions, analyzing if your portfolio is up to the mark, getting the latest updates from the news, and placing orders. On the other hand, mobile applications developed by Fidelity are updated and equipped with all the latest features. For instance, you can check all your pending transactions and safely place trades without worrying about security hazards. Yet, there are some regions where the app needs to catch up falls, with the fundamental research being one significant backdrop. Consumers can sync the application with desktop and web applications to maximize the features. Both applications have good ratings on app stores. However, Fidelity has far more positive customer reviews than Vanguard.

4: Offerings

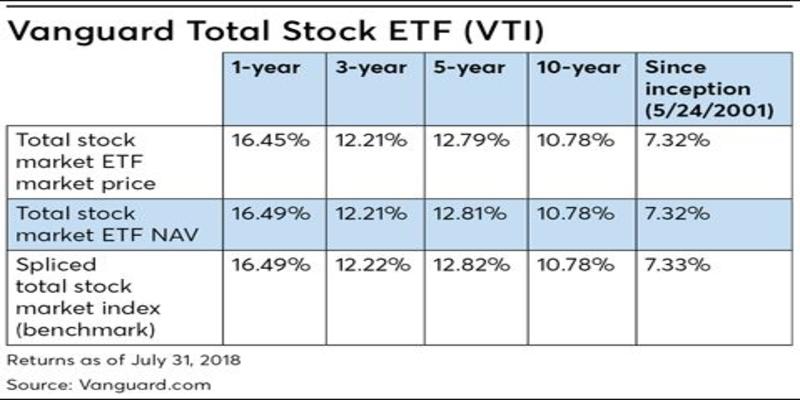

Although both Fidelity and Vanguard are famous for providing extended services to the consumer compared to others, the question of which one is better remains the same. Vanguard has limited offers regarding bonds, options, ETFs, and hundreds of no-load and no-fee mutual funds. With the service, customers are restricted to choosing futures, options on futures, forex, etc. In contrast, Fidelity offers a broader range of facilities than Vanguard. This includes the previous metals, OTCBB, and fractional shares for anyone to purchase. Assets available on Vanguard

- Stocks

- mutual funds

- ETFs

- Bonds

- CDs

- Options

- different types of currencies

Assets available on the Fidelity app

- Stocks

- Mutual funds

- ETFs

- Bonds

- Cds

- Options

- OTC training is restricted except for specific ADRs.

5: Order types

Customers and app users are not allowed to use the intelligent order routing technology as it is not offered. At the same time, they need help to route their orders. The broker reports the net price improvements of about 2.31 dollars per 100-share lot for eligible marketable orders . Fidelity offers an intelligent order routing service, allowing consumers to seek all the best prices. It also gives them access to all the market venues, including dark pools. Exchanges, market shares, and the list goes on. The company reports the net price improvement at 19.24 dollars per 1000 share equity order. Hence, Fidelity wins the race for trading technology with its innovative order routing technology and superior price improvements.

6: Costs

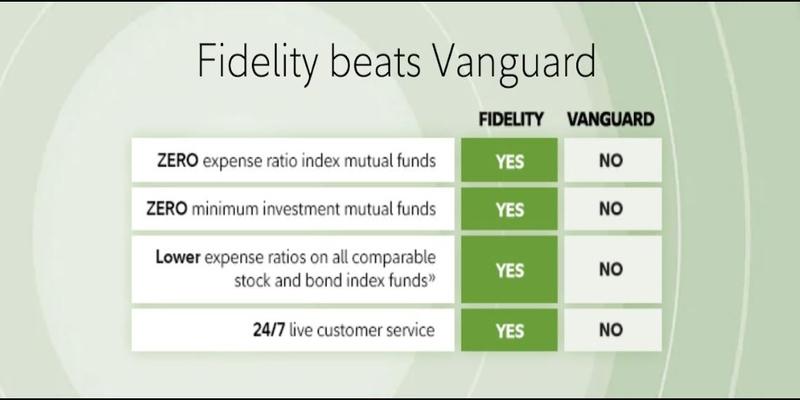

Cost remains the pivotal factor when considering the options. Both services are highly competitive as none charges a commission for online options, equity, and ETF trades. Nevertheless, Fidelity has a 0.65 fee for a single contract option, whereas Vanguard charges 1 dollar for the same service. In addition, Fidelity is suitable for broker-assisted stock trades, where it charges 32.95 dollars, whereas Vanguard has a fee of 25 dollars. The margin rates for both brokerage accounts are close, where Fidelity charges 10.575% for 10000 10,000, whereas Vanguard charges 10.75% for the same amount.

7: Account Search

Vanguard offers the consumer the fundamental screeners. They can use it for ETFs and mutual funds. At the same time, find news provided by MT Newswires and associated press. The charting for the traders is limited, and they can not avail of the facility of technical analysis as well, Fidelity also wins the race with its research offerings, which obtain flexibility screeners such as Stocks, ETFs, fixed income, and mutual funds. It also extends to selecting tools, calculators, and news sources.

Final thoughts

On the bottom line, Fidelity and Vanguard are two popular options in the world of online trading that have continued to cater to and satisfy customers for a long time. Nevertheless, as a new trader, knowing the best option among these two top choices is imperative. The same is why we have formed this head-to-head battle between the services that declared Fefility a more efficient and must-try service than Vanguard.