Get To Know The Reason Behind The Importance of 10-Year U.S Treasury Yield

The 10-Year Treasury is often referred to as the weatherman for the lending market. When the yield on those government securities fluctuates, it can signal a change in the weather across the entire lending market, from bond to mortgage rates and everything in between.

Its widely considered the safest of all long-term investments, and its the most commonly quoted interest rate benchmark around the world. Even if youre not a bond investor, the 10-year treasury yield can serve as a benchmark to measure future cash flows for assets you own.

Today, well look at why the 10-year U.S. treasury yield matters and how they affect your investments. So, let's dig in to get the answer!

What Is a 10-Year Treasury Yield?

- What Does the 10-Year Yield Mean for Investors? When the 10-year yield changes, it can signal investor confidence in the economic outlook. When the yield changes on a 10-year bond, it can signal a shift in all borrowing rates, including interest rates on bonds and mortgage rates. A rising 10-year bond yield can also be a barometer of interest rates on mortgages, student loans, and other types of borrowing.

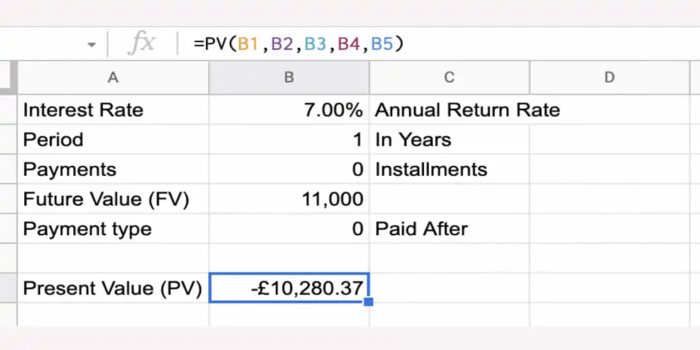

- What Is The Value of Future Cash Flows in the 10-Year Treasury? Companies' future cash flows are often used as the benchmark for determining their market value. When the 10-year yields rise, their future cash flows are discounted to a larger rate, meaning that their values are worth less than when interest rates were lower.

How Does It Work?

U.S. 10-year Treasury notes have a $1,000 face value and a coupon that specifies the interest rate to be paid each six months. The Treasury issues the notes at auctions run by the Federal Reserve and sells them to institutional investors, such as banks and other financial firms.

The notes are then sold in the secondary market to investors. The action of the secondary market determines yields. Bond prices fluctuate almost all the time. The price of a bond is inversely correlated to its yield. When there is high demand for a bond, and Treasury prices go up, yields go down.

Conversely, when there is low demand, and Treasury prices go down, yields go up. This ebb and flow in bond prices is what makes up the Treasury pricing market. Investors flock to and away from Treasuries depending on the economic conditions they find themselves in.

Why Is the 10-Year Treasury Yield Important?

The 10-year Treasury Yield is a key economic indicator and affects many other interest rate movements. Mortgage rates rise when the 10-year Yield rises, and when the 10-year Yield falls, mortgage rates also decline. This strengthens the housing market, which has a positive effect on economic growth.

The 10-year Treasury Yield also affects the borrowing rate of companies. When the Yield rises, companies face higher borrowing costs, which may limit their ability to participate in growth and innovation-oriented projects.

Rising treasury yields suggest that investors are seeking higher-return investments. Still, it could also scare investors who worry that rising rates could pull capital out of the equity market. When the 10-year Yield falls, falling the yield suggests falling corporate borrowing rates, which ease the burden on companies to borrow money and expand, providing a lift to equities.

The 10-year Treasury Yield is a key economic indicator and affects many other interest rate movements. Mortgage rates rise when the 10-year Yield rises, and when the 10-year Yield falls, mortgage rates also decline. This strengthens the housing market, which has a positive effect on economic growth.

The 10-year Treasury Yield also affects the borrowing rate of companies. When the Yield rises, companies face higher borrowing costs, which may limit their ability to participate in growth and innovation-oriented projects.

Rising treasury yields suggest that investors are seeking higher-return investments. Still, it could also scare investors who worry that rising rates could pull capital out of the equity market. When the 10-year Yield falls, falling the yield suggests falling corporate borrowing rates, which ease the burden on companies to borrow money and expand, providing a lift to equities.

Should You Invest in 10-Year Treasuries? Buying treasuries is a good idea for a number of reasons:

- First, as mentioned above, there is no safer investment than a bond. Investors should include some bonds or other types of fixed-income investments to improve portfolio diversification. So, fixed-income bonds are a part of your investment strategy.

- Second, bonds offer guaranteed income, so your investment will remain safe no matter what the economy or financial markets do.

- Third, if you are in retirement, your bond allocation should be much higher with a combination of high-yield bonds that can provide an income stream and lower-yield bonds to preserve your capital. Many retired people, especially those who work closely with financial advisors, like to build bond portfolios that include a variety of maturities to create an ongoing stream of income.

Is Your Money Safe In A Treasury Yield?

In short, yes. The government covers your principal, so you cannot lose your money in a treasury yield. Treasury bills, on the other hand, are subject to inflation. If an investor buys a bond today and then inflation happens, their principal will be worth significantly less by the time the bonds term expires. While that investor gets his principal plus interest, hes effectively losing money because the money is worth less when he takes it out.

One of the fundamental principles of finance is the relationship between risk and return. When the markets are high, and growth is strong, theres a lot of demand for risk and returns. A risk-free bond becomes much less attractive because of its lower return. Demand goes down, and treasuries sell at a discount on their nominal value.

Conclusion

10-year Treasury Yield is undeniably a measure of investor confidence. It moves inversely to the price of 10-year T-bills and is one of the most risk-free investments you can make. You may want to talk to your financial advisor about investing in treasuries, but it pays to keep an eye on the yield on treasuries.

Whether youre looking to buy stocks, buy a home, buy a car, or take out a loan to start a business, the ten-year treasury rate has an impact on everyone. Hope this article Why the 10-Year U.S. treasury yield matters has cleared all of your doubts.