How First-Time Homebuyer Tax Credit Works

Are you fantasizing about being a first-time homeowner? Well, good news! There's a thing called First Time Homebuyer Tax Credit that may assist you. This program is intended to help people that will be purchasing their first home by providing a financial bonus.. It's a sort of little extra to help you buy your first home to be a bit cheaper for your purse. Now, let us explore the advantages of this and how it can benefit you.

What is the First-Time Homebuyer Tax Credit?

The government helps a stressed homebuyer to have a house of their own. But, they will fund it through what is called the First-Time Homebuyer Tax Credit. It is like a fine savings strategy or a little gift for those that buy a house. It is a helping hand from the government to people just beginning their property ownership journey. At the beginning of buying the home, it can be quite expensive with all the fees from the initial deposit to the closing. However, this tax credit can be stunning when filing your tax return.

How to Claim the Tax Credit?

Getting Started

The main thing to do to benefit from the First-Time Homebuyer Tax Credit is to have all the required documents with you. Apart from that, you also have to supply your income-related documents, like the W-2 forms.

Complete the form

When you have all you need for the application including the IRS form, the First-Time Homebuyer Tax Credit can be filled. To keep things simple, just fill in the essential details. Provide the relevant information in the right places.

Double-Check Everything

Proceeding with tax submission with First-Time Homebuyer Tax Credit, you should take a few minutes to do a final review. Moreover, make sure that you have not overlooked or committed any mistakes or inconsistencies that could delay the process of filing your tax return.

Submitting Your Tax Return

Once you have confirmed that every detail is in order, input your tax return together with the Form of First-Time Homebuyer Tax Credit. If e-filing, then it is advised to confirm that the attachments are securely attached.

Waiting for Your Refund

Following submitting your tax return, the last part of the process is waiting for your refund to arrive. The processing time can differ depending on the individual's filing method and the tax authorities' workflow. Be patient, and you will receive the refund in due time, which could be the tax credit you applied for as a first-time homebuyer.

Maximizing Savings

Research and Preparation

Before you start your first housing transaction, take the time to do proper research. Become proficient with the First-Time Homebuyer Tax Credit and all its consequences. Understanding the requirements for eligibility and required documents will simplify the process, and you will achieve a more significant effect on your savings.

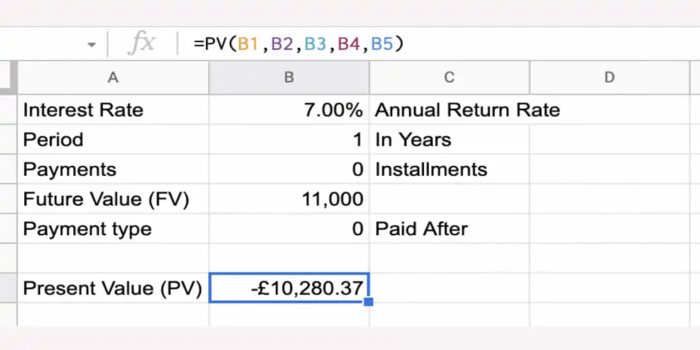

Financial Planning

Efficient financial planning is one of the best tools for using First-Time Homebuyer Tax Credit. Carefully look at your financial condition, including initial deposit, closing costs, and monthly mortgage installments. Also, talk to financial advisors or tax experts and use their advice to maximize your tax strategy. Use all the credits available.

Utilize Available Resources

Many options and services are available for people purchasing their first home to help them understand and deal with the buying process. Government initiatives like down payment assistance programs and housing counseling services can provide good help and guidance for home buyers when buying a house. Utilizing these tools leads to an increase in your purchasing power and a hassle-free transition into the first house.

Explore Additional Incentives

Furthermore, consider other tax credits and advantages you may be eligible for while applying for the First-Time Homebuyer Tax Credit. Among the options available for first-time homebuyers, state-funded programs, employer's assistance programs, and mortgage lender incentives are included. By doing this, you can find other ways of doing this and have a dream house.

Importance of the Tax Credit

Making Homeownership Possible

For many people, homeownership is a big dream, which is a great thing, but the cost can be the thing that stops them from getting it. The tax credit comes to the rescue as well, where needed. Well, it is great because more people get to live in a place that provides comfort and happiness.

Encouraging Homeownership

The tax credit benefits individuals and facilitates the expansion of the homeowner's population. People are more willing to try hard and take that big step when they learn that the government can help them buy a home.

Supporting Citizens

The government understands and feels for its people and one of the ways it shows this understanding is through the tax credit. The government achieves this by giving tax breaks to citizens to help them achieve their aspirations of home ownership. It is just like a little reward for all your hard work, telling you that we will be there to help you in this life-changing moment.

Boosting the Economy

Not only will people benefit from home buying, but the whole economy will also benefit. It boosts the job market in the building and home improvement sectors. In addition, when people own their homes, they usually take care of what they have and improve their community with their efforts, which benefits everyone in the neighborhood.

Conclusion

The First-Time Homeowner Credit Tax is a very vital policy tool for the ones who are beginning to make their own homes. The criteria for eligibility and saved funds selection can be utilized wisely by potential homeowners to get the maximum output and at the end they can achieve their dream of homeownership. Proper research, financial planning and smart decisions on other incentives will be the first step in overcoming the difficulties of the real estate market with certainty and confidence.