How OPEC( and Non-OPEC) production affects oil prices

Crude oil is a highly demanded commodity worldwide, and prices frequently fluctuate, impacting economies in multiple ways. OPEC is one of the largest contributors to these fluctuations, which can cause a high fall in prices.

Wondering how? Stay tuned with us; the forthcoming content will discuss how OPEC (and non-OPEC) production affects oil prices.

Unleashing How OPEC( and Non-OPEC) production affects oil prices

What factors affect the prices of oil

Crude oil is a need of every nation today. Thus, the price can fluctuate in reaction to an extensive variety of variables. For instance, any nation's economic growth can increase the demand and consumption level of oil. Thus increasing the prices. When prices come down, it might be a clear indication of an economy failing a significant decline in its consumption level and overall growth.

At the same time, OPEC and OPEC+ also have big effects on oil prices through their influence in the global supply chain.

Understanding the relationship between OPEC and oil prices

OPEC is an abbreviation for the Organization of the Petroleum Exporting Countries. As the name says, it is a specific type of assembly that determines oil production targets to meet oil consumer needs globally.

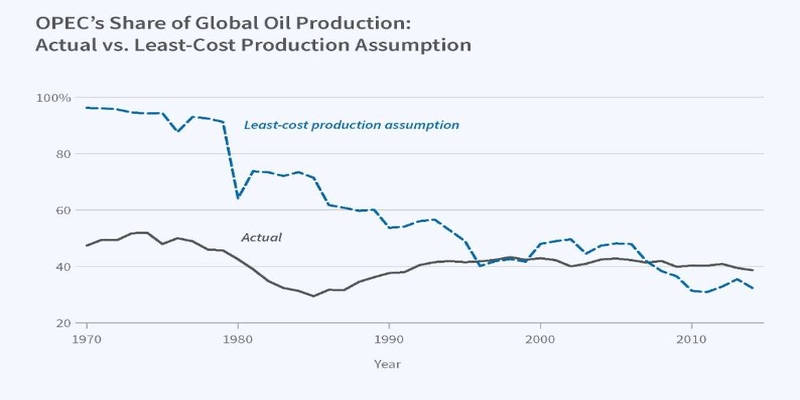

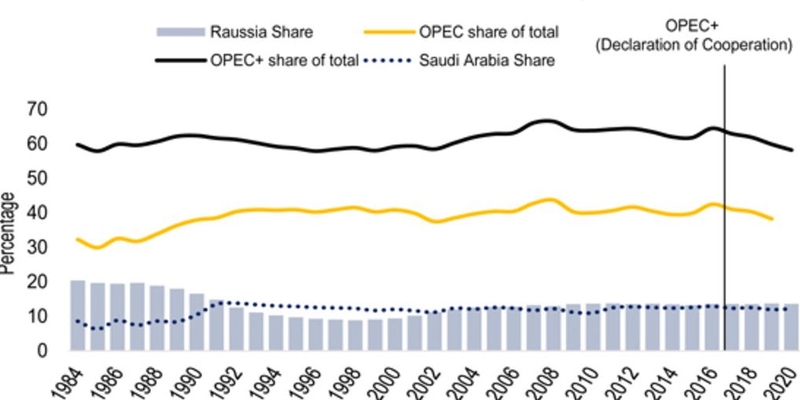

According to a United States Energy Information Administration study, OPEC member countries supply 40% of crude oil to the world economy, of which 60% of the exports are related to the petroleum trades.

Because of the significant market share obtained, OPEC can influence the international policy process through lobbying. The organization seeks stable, affordable and sustainable pricing strategies to provide fair returns to the producers and investors.

Worldwide data shows that pOil prices have always increased. OPEC has reduced its production targets for various reasons.

The influence of OPEC and Non-OPEC contribute on oil prices

The oil-producing countries are either part of the OPEC organization, OPEC+ or non-OPEC organization. Till now, OPEC has included 13 countries under its member list, including Congo, Equatorial Guinea, Gabon, Kuwait, Libya, Algeria, Angola, Nigeria, Saudi Arabia, Venezuela and the United Arab Emirates.

In 2016, more nationals joined the OPEC (Which was part of the non-OPEC organization), giving rise to the idea of OPEC+. It includes some of the world's significant economies, such as Bahrain, Mexico, Kazakhstan, Brunei, Russia, South Sudan, Sudan, Azerbaijan, Oman, and Malaysia.

The influence of OPEC+ is far larger than that of OPEC due to the larger number of players entering to use their connections to influence the prices. Thus creating a highly dynamic environment which makes changes in oil production capacities and supply of crude oil/

OPEC's influence on oil production and prices

Opec is accountable for exploring 60% of total petroleum needs worldwide. At the same time, 80% of the world's crude oil reserves will be within the countries that are members of OPEC or OPEC+ by 2021.

All these members have separate research centers along with continuously evolving technologies which they use. These member territories claim to use all such resources to enhance oil production further and make it available in the world market at lower prices than usual.

Influence of OPEC on Oil Princess Worldwide

Being the extended version of OPEC, OPECT+ holds more control and is responsible for supplying 50% of the world's oil needs. The organization has gained such control mainly due to the absence of alternative sources. At the same time, there are not enough alternatives to crude oil in energy-consuming sectors, ultimately giving more power to OPEC+.

The impact of the non-OPEC organization on the global oil prices

of non-OPEC countries refers to all those nations that can produce oil but lack the interest of being a part of OPEC. The list includes some fast flourishing economies such as Canada, China and the United States of america.

These nations have a high level of consultation, which limits their capacity for exports. The same is why many oil producers, despite producing more oil than the OPEC members, cannot export due to extremely high demand within the territory. Hence, they have a very limited influence on the prices of oil.

The United States has also enhanced the oil production level within its refinery. Yet, the consumption and demand are so high that it can still be on the list of top oil exporters.

At the same time, the high production from non-OPEC during the early 2000s has yet to gain a sufficient share of the oil world market and failed to make any substantial changes in the prices.

Factors through which OPEC and Non-OPEC producers affect oil prices

Market dynamic

The relationship between OPEC, OPEC+, and non-OPEC players creates a highly dynamic environment. If OPEC decides to cut production to boost prices, the non-OPEC members might increase their production for capitalization. Thus offsetting OPEC's efforts.

Geographical conditions

Geographical factors also influence the price of oil. For instance, if there is a conflict among major oil-producing countries, the disruption in oil infrastructure would affect the prices all across the globe. This is why all OPEC and non-OPEC producers must navigate such complexities when making decisions.

Effects on the global economy

Oil price fluctuations have significant implications for the economies. If the oil price goes up, the production cost for business automatically rises.

It includes multiple other factors, such as high consumer costs, inflationary pressures, and a decline in the purchasing power of the money.

On the other hand, the lower prices of crude oil can stimulate economic growth by reducing the input costs. Thus lowering the other expenses for business, including transportation and cargo.

As oil-exporting countries strive hard to minimize their dependence on oil revenues, significant fluctuations in price can have major impacts on fiscal stability.

Final thoughts

On the bottom line, crude oil is one of the necessities of today's world, and price fluctuations can drastically affect nations. OPEC and non-OPEC producers play a significant part in such price changes. Read the content above carefully, discussing how OPEC( and non-OPEC) production affects oil prices.