The Importance of Other Comprehensive Income

Gains or losses anticipated to affect a company's balance sheet are referred to as other comprehensive income in financial analysis terminology. Although these gains and losses impact a company's net income, it usually decides not to disclose this influence on an income sheet. OCI transactions are listed after net income on a financial statement by workers because they do not affect an organization's total earnings. A company's financial and economic health can be determined by its financial statements. A company's gains and losses may be disclosed through various assets and aspects included in these filings, such as other comprehensive income. Organizations can better comprehend their financial progress. No more delay; lets shed light on the importance of other comprehensive income.

Why Is Other Comprehensive Income Important? An Overview

What Does Other Comprehensive Income Include?

Any items that a business or individual deducts from their net income are the main components of other comprehensive income. Examples of values that a business could reject are as follows:

- Gains or losses on foreign exchange

- Profits from investing

- Investment losses

- Gains and Losses for Pensions

What Distinguishes Realized Income From Other Comprehensive Income?

A few main distinctions exist between realized income and accumulated other comprehensive income. Several of these variations consist of:

A few main distinctions exist between realized income and accumulated other comprehensive income. Several of these variations consist of:

Location of Financial Statement Located

Financial statements are formatted consistently so that everyone who examines the report may comprehend what they're studying. Realized income is always shown on the balance sheet because it directly affects a company's net income. Businesses only include OCI on a balance sheet to give investors a more thorough breakdown of the gains and losses they might anticipate. In the equity portion of the report, OCI is listed as a line item when a corporation chooses to include it. OCI can occasionally be found in a different comprehensive income statement. This document displays all of the OCI apart from any retained earnings.

Main Purpose

Any amount of cash that a business has earned and received is referred to as realized income. This can include wages, interest gained from accumulated balances, and other forms of income for a corporation. Realized income serves as evidence of completed transactions that affect the business's net income. As an alternative, OCI aims to assess the company's worth distinctively by providing a more comprehensive picture of net income overall. Uncompleted or unrealized transactions, or OCI, show how a company's net income and comprehensive income balance out. Over time, OCI may turn into realized income, which could lead to a business including it in its financial statement, particularly if it is having difficulties while its assets are doing well. It is helpful to display or acknowledge these assets to obtain a more comprehensive understanding of the organization's financial situation.

Impact &'' Influence

Realized income, as shown in a financial statement, aids analysts in comprehending the present financial situation of a business. The financial statement shows a company's revenue and spending habits by enumerating all completed transactions inside the company. Because realized income correctly reflects the active condition of the company's finances, it can assist a business in forecasting or making critical financial choices. Additionally, comprehensive income contributes to a better understanding of the possible gains and losses that a business anticipates. If a corporation sold its assets and the profits were turned into realized income, it might provide prospective and existing investors insight into the company's value. Since OCI eventually turns into realized income, disclosing it to stakeholders on a financial statement can help them understand why a company's net income could change in the upcoming weeks or months.

What Distinctions Exist Between Comprehensive Income And Other Comprehensive Income?

Comprehensive income (CI) and OCI are different. First, whereas CI is included in net income, OCI is not. Second, CI covers the same values and values that are a component of net income, but OCI only consists of a narrow subset of values. In a nutshell, CI represents the overall shift in equity for the person or organization, but OCI does not.

Comprehensive income (CI) and OCI are different. First, whereas CI is included in net income, OCI is not. Second, CI covers the same values and values that are a component of net income, but OCI only consists of a narrow subset of values. In a nutshell, CI represents the overall shift in equity for the person or organization, but OCI does not.

Accumulated Other Comprehensive Income

A company's total income from all sources is included in its accumulated other comprehensive income. The OCI of a business might consist of a range of costs, profits, losses, or gains. Typical forms of cumulative other comprehensive income include the following:

Transactions Using Foreign Currencies

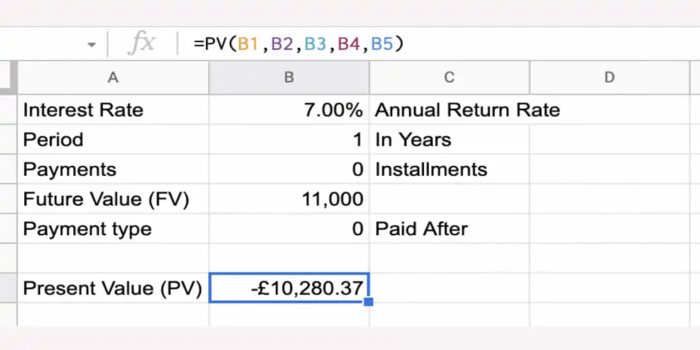

Your account balance may alter as foreign currency values fluctuate if your employer transacts in multiple currencies. Furthermore, the exchange rate for specific currencies could impact the corporation's holdings. As an illustration, consider this: An American-based business predominantly conducts business in the United Kingdom. It pays in British pounds (GBP) when it receives payments from customers in the United Kingdom. American companies must convert the GBP into US currency.

Pension Schemes

These post-retirement benefits, which come with a pension paid by the employer to its employees, may include realized gains and losses. Although every pension plan is different, depending on the money invested, a corporation may see an increase or decrease in its pension liability. The type of plan the company utilizes and the average employee contribution determines how much of an impact a pension plan has on an organization's overall capitalization rate (OCI).

Conclusion

Understanding the importance of other comprehensive income is vital for assessing an entity's financial health. It gives investors and analysts a more complete picture by illuminating gains and losses not shown in net income. OCI includes many items, including modifications to pension plans, investment profits, and foreign exchange gains. Making the distinction between realized revenue and OCI helps forecast financial situations in the future.