Things to Know Before Starting Trading Options

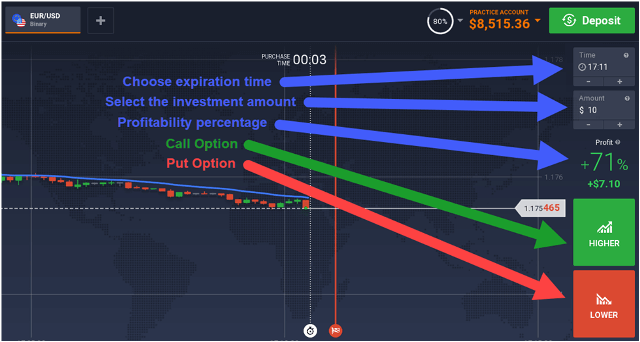

As a beginner, here are important tips to remember that would help you better understand and start trading options. It's not as difficult as people think about options; options work like a vehicle to understand options and stock in various ways. You need to understand the options, strategies, and types of options. Typically, two types of options are used: call and put options. In this article, you will learn which things you must keep in mind if you want to begin options trading. So, let's get started.

Trading Small Amounts of Your Own Money

When you start options trading, remember that trading a large amount of firm capital is not the same as trading a small amount of your own money. When you start option trading from a low amount, you still have a large amount to invest. In starting option trading, Danger tolerance is a skill that must be learned, So you can not increase the amount of investment strikingly. The amount of funds you are trading will vanish at once. When you are worried about the size of your loss, though it's common for that procedure. Despite all this, you will be out of the business earlier. Trading in small quantities of investment is different from trading in large amounts. Emotionally and psychologically, it is quite a separate procedure. All this process needs practice, and paper trading is essential for beginners.

Practice With Paper Trading

Paper trading is where you trade through a fake platform using fake money. Online brokers allow you to trade through fake money, and as a result, you gain experience. Practicing paper trading is an excellent way to get experience before starting to trade with real money. This allows you to test your strategies and gain useful experience without fearing financial risk. Fear can mean profits for options trading.

Fear Can Be Big Profits for Options Trading

Fear should not be the decision-making factor and should not drive your behaviour. If fear drives your trading decisions, you can not be a successful trader in the long term. Fear can be profitable when you find profitable options and trades. It is a time when stock is going down, and if your decision-making ability is strong, you can set up a risk-reward options trader nicely.

Practising Patience is the Key Route to Success

As a beginner, patience is critical in all forms of trading. Specially in the time of market volatility, don't rush for a quick profit, and never let your emotions dictate your decisions. Options trading demands discipline and patience so that you can stick to your plan and you can resist against to deviate your goals.

Career Patience

Patience is also critical in all forms of your options trading career; you have patience with your learning process.

Execution Patience

You can't take career risks when you are a beginner options trader; secondly, when you are in an execution situation, it is time to make a trade. Have patience because there's a certain trading time option that allows your strategy to work efficiently during that certain trading period.

Learning Curve Patience

You have to be patient with your learning curve and keep in mind that you won't learn option trading strategies in a short time. The normal learning curve for beginners is about six to 24 months needed.

Capital Sizing Patience

It is emphasized that you require capital sizing patience to become a successful trader. You must understand that you can't expose a large amount of capital to the market until you have been trading for a while. Increase your capital slowly, and plus it gives you the ability to build your risk tolerance. So you don't freak out when you are down a large amount of capital. So, you don't freak out when your large amount of capital is down, and it requires diversifying your strategies.

It is emphasized that you require capital sizing patience to become a successful trader. You must understand that you can't expose a large amount of capital to the market until you have been trading for a while. Increase your capital slowly, and plus it gives you the ability to build your risk tolerance. So you don't freak out when you are down a large amount of capital. So, you don't freak out when your large amount of capital is down, and it requires diversifying your strategies.

Diversification of Your Strategies

Diversification of strategies is a very technical point. If you trade one strategy, that gives you one set of best results that will be optimal for your strategy. If you have a list of strategies that balance each other, that's the best blend. Three things affect option trading time: the price of the underlying asset that is being traded, the option is derived from, and the volatility. You can make new effective strategies based on your past strategy. The best portfolio of strategies is a mix of trades that will respond well to every movement in those three factors.

Successful Traders Know Losing is Not A Capital Offense

The ego is the major reason that many traders fail. They are unable to admit that the trade is not going their way. Losing is not a capital offense. If you are losing and not stopping, it means you are not following the discipline and you are not following the system. Successful traders have losing periods; in fact, if you did not have losing periods, you would not be able to make any money trading.

Keep it Simple

As a beginner, avoid making any unnecessarily complicated strategies and keep them simple. If you make difficult strategies, it's difficult to exit them anywhere near the profit. The simpler the execution, the better your strategy, and you will gain positive output in trading. So, start to simplify your techniques.

Bottom Line

As a beginner, you should know the facts about trading options. It would help if you learned the basics of options trading, from practicing paper trading to starting your own small business and making effective strategies; a beginner must remember these tips. Patience and consistency are key if you want to begin option trading. These factors are the bottom line for being a successful options trader.