Year To Date (YTD) Steps To Calculate, Formula, Example, And More

To assess the long-term profitability of their assets, investors frequently monitor the performance of their investment portfolios. In that instance, rather than referring to a percentage return, the year-to-date (YTD) probably references the company's financial results. Firstly, the company can evaluate its performance to date, compare its present trajectory to previous periods and internal projections, and use YTD performance to benchmark against similar businesses in the same or a related industry. To evaluate the current status of the company's performance and determine whether adjustments are required to meet the management team's goals, one can look at the sales performance trend or the returns on a portfolio. Here's a comprehensive guide if you want to know how do I calculate the year-to-date YTD Return on My Portfolio.

What Is Meant by Year to Date?

When we talk about the year-to-date (YTD), we mean the time from January 1st of the current year to a predetermined date at the end of the year. This kind of computation offers insight into the financial performance during that intermediate period for a company, investment, or individual. Evaluating performance throughout the year is possible by analyzing YTD numbers instead of waiting to consider it until the end of the year. YTD figures can be compared to similar periods in prior years to identify emerging financial trends and problems.

YTD Return Comparison

How to Calculate YTD Returns

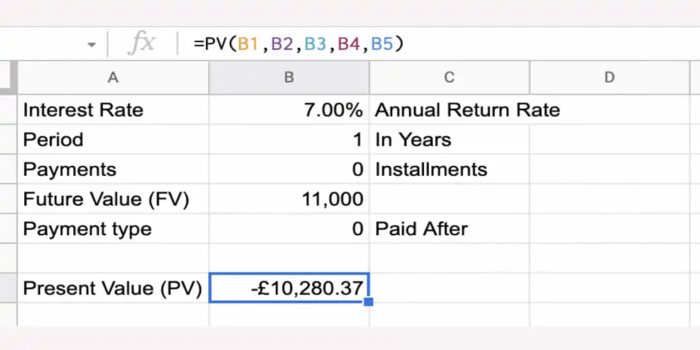

The YTD return of a portfolio can be calculated in the same way as it can be for a single investment. Calculating your YTD return is as follows:

The YTD return of a portfolio can be calculated in the same way as it can be for a single investment. Calculating your YTD return is as follows:

- Step 1: Find the portfolio's starting value at the beginning of the year and its current value.

- Step 2: Deduct the portfolio's current value from its value at the beginning of the year, say January 1. The YTD return in USD is the outcome.

- Step 3: Calculate the YTD return in dollars by dividing it by the portfolio's initial value.

- Step 4: To convert the decimal number into a percentage, double the result from step three by 100.

The outcome is a portfolio's % YTD return. The year-to-date return formula is as follows: Year to date = ((Current value - Beginning value) / Beginning value) * 100

YTD Return Example

Let us assume that as of January 1st this year, a $50,000 stock portfolio comprised the following three stocks: $10,000 for Stock A $15,000 for Stock B $25,000 for Stock C. Value of the portfolio at the beginning of the year: $50,000 At midway through the year, the stock portfolio's performance was assessed using a YTD return analysis completed on June 30. $13,000 for Stock A, $18,000 for Stock B, $24,000 for Stock C Portfolio worth as of June 30: $55,000 The YTD Return on the Portfolio is ($55,000 - $50,000) / $50,000 =.010 * 100 = 10% The yield-to-date (YTD) return in US dollars was $5,000 (or $55,000 - $50,000), and the yield-to-date percentage was 10%. It's crucial to remember that portfolio weighting needs to be considered when investing. The return of a portfolio will be more affected by its higher-weighted holdings than by its lower-weighted holdings, for instance, if more than 50% of the portfolio's capital is invested in a single firm or industry.

Accounting For Dividends And Interest

Since interest and dividends are part of the gain, any amount paid by an investment during the year must be reflected in the portfolio's current value. After that, the YTD return would be determined as follows: Portfolio YTD Return: ($55,500 - $50,000) / $50,000 = .011 * 100 = 11% As we can see, an investment or stock that yields a dividend or interest can support a portfolio's year-to-date return (YTD).

What Is a Reasonable Year-to-Date Rate of Return?

How a portfolio performs concerning a comparable standard determines a fair rate of return. For instance, a stock portfolio's year-to-date return (YTD) may seem significant compared to a bond fund, but comparing it to an equity benchmark such as the S&''P 500 is more meaningful.

Limitations Regarding the YTD Return

Although YTD measurement is significant, remember that it only provides limited information and could overemphasize short-term success.

Moreover, seasonality in earnings and revenue may not be taken into consideration by YTD return analysis. When comparing a retailer's YTD return to non-retail companies earlier in the year, it may seem like the shop is underperforming.

However, if the retailer's holiday sales were noteworthy, it might exceed other businesses by the end of the year. More extended time frames must be considered, even though YTD return analysis enables investors to adjust by changing the asset allocation in their portfolio.

Although YTD measurement is significant, remember that it only provides limited information and could overemphasize short-term success.

Moreover, seasonality in earnings and revenue may not be taken into consideration by YTD return analysis. When comparing a retailer's YTD return to non-retail companies earlier in the year, it may seem like the shop is underperforming.

However, if the retailer's holiday sales were noteworthy, it might exceed other businesses by the end of the year. More extended time frames must be considered, even though YTD return analysis enables investors to adjust by changing the asset allocation in their portfolio.

Conclusion

That is all you need to know about how I calculate the year-to-date YTD Return on My Portfolio. For investors, it is figuring out your investment portfolio's Year-to-Date (YTD) performance. It provides an easy-to-use method for evaluating how well your assets have done since the start of the current year. Investors can assess their progress toward financial goals, make informed judgments about their investment strategies, and make necessary portfolio adjustments by using the straightforward formula and comprehending the meaning of the YTD return.